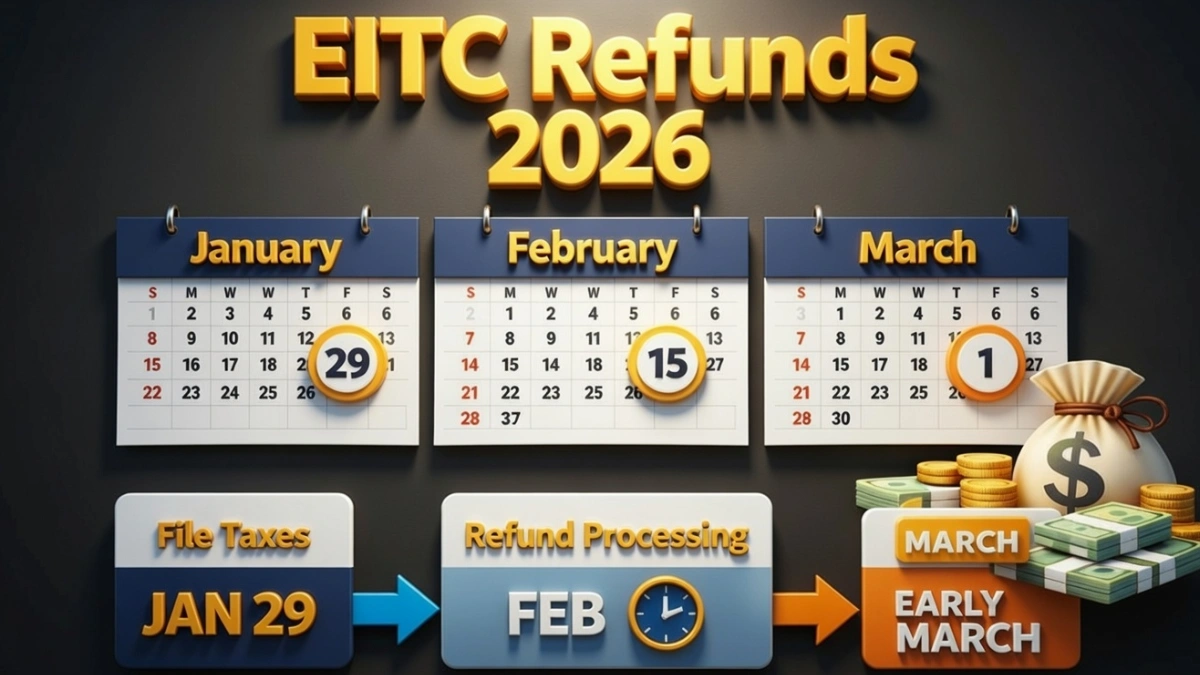

EITC Refund Alert 2026– The IRS has confirmed that Earned Income Tax Credit (EITC) refunds in 2026 will be processed later than standard refunds, with many taxpayers receiving funds in March 2026. The delay is due to additional verification measures designed to prevent fraud and ensure accurate payments.

Who Receives EITC Refunds

EITC refunds are targeted at low- to moderate-income workers and families who qualify based on income, filing status, and number of dependents. Taxpayers claiming this refundable credit must have their information verified before refunds are released, contributing to the March timeline.

Why Refunds Are Delayed Until March

The IRS must review EITC claims more thoroughly to prevent fraud. New filing rules, additional verification of income and dependent information, and automated fraud checks mean that these refunds take longer than regular returns. Beneficiaries should expect patience.

Estimated Refund Timeline

Taxpayers who claim EITC and file early can expect refunds starting mid-to-late March 2026. Direct deposit is still the fastest method, but paper check recipients may experience longer delays. Early filing ensures smoother processing once verification is complete.

How to Track Your EITC Refund

The IRS provides the “Where’s My Refund?” portal and mobile app to track the status of EITC refunds. Taxpayers need to enter their Social Security number, filing status, and expected refund amount to see processing progress and estimated deposit dates.

EITC Refund 2026 Overview

| Feature | Details |

|---|---|

| Refund Type | Earned Income Tax Credit (EITC) |

| Expected Deposit | Mid-to-late March 2026 |

| Distribution Method | Direct deposit or mailed check |

| Eligibility | Low- to moderate-income earners meeting EITC criteria |

| Verification Required | Income, dependents, and filing information |

This table summarizes the timeline and verification requirements for EITC refunds in 2026.

Tips for EITC Beneficiaries

Ensure Social Security numbers, dependent information, and income details are accurate when filing. E-filing with verified bank accounts reduces delays. Regularly monitoring IRS portals helps stay informed about any processing issues or updated timelines.

Conclusion

Millions of taxpayers claiming the EITC in 2026 will receive their refunds in March due to additional verification requirements. By filing accurately, using direct deposit, and tracking the refund status online, recipients can ensure timely and secure receipt of funds.

Disclaimer: This article is for informational purposes only. EITC refund dates, eligibility, and processing timelines are subject to official IRS notifications and may vary based on individual filings and federal regulations.