Tax season is officially underway, and millions of Americans are eager to know one thing: When will my IRS tax refund arrive in 2026? With rising expenses and tighter household budgets, timing matters more than ever. While the IRS follows a general processing pattern each year, updated schedules and verification rules can affect how quickly your money hits your bank account.

Here’s a clear and updated look at the 2026 IRS refund schedule, expected deposit timelines, and what could speed up — or slow down — your payment.

When Did the 2026 Tax Season Begin?

The IRS typically begins accepting federal tax returns in late January. Once filing opens, electronically submitted returns immediately enter the processing queue.

Taxpayers who file early often receive refunds faster, especially if they choose direct deposit. However, filing early does not automatically guarantee approval within days. The IRS still applies verification checks and fraud prevention filters before releasing refunds.

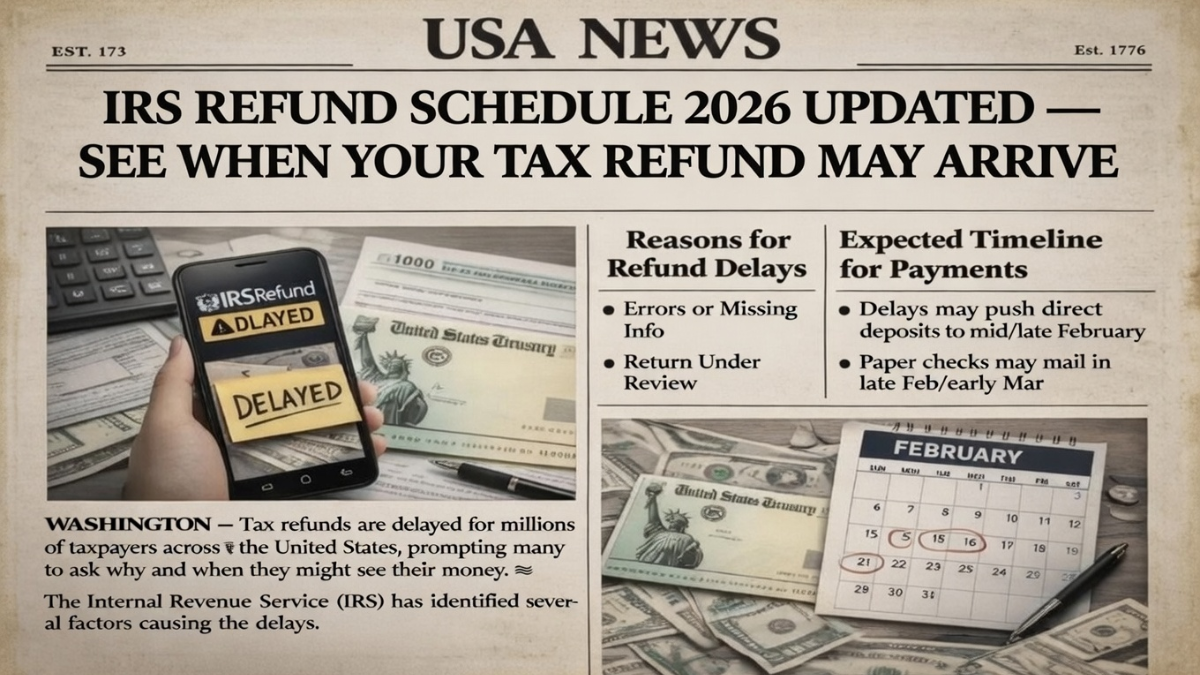

Expected IRS Refund Timeline for 2026

For most taxpayers, the standard refund processing window remains around 21 days for electronically filed returns with direct deposit.

Here’s what that generally means:

If you filed in late January, your refund may arrive in mid to late February.

If you filed in early February, deposits may arrive by late February or early March.

If you filed in March, refunds may be issued within three weeks, depending on processing volume.

Paper returns may take six to eight weeks or longer.

Keep in mind that these are estimates. Refund timing depends on accuracy, filing method, and whether additional review is required.

Why Some Refunds Arrive Faster

Certain factors can help you receive your refund more quickly.

Electronic filing reduces manual processing errors.

Direct deposit eliminates mailing delays.

Accurate information prevents verification holds.

Simple returns without complex credits process faster.

Taxpayers with straightforward filings and no identity verification issues often receive their refunds within the standard three-week timeframe.

Why Some Taxpayers May Wait Longer

While many refunds move quickly, some returns require additional scrutiny.

Refunds that include the Earned Income Tax Credit or Child Tax Credit may undergo extra fraud prevention checks. Federal regulations require the IRS to verify eligibility before releasing these refundable credits.

Errors such as mismatched income details, incorrect Social Security numbers, or missing documentation can trigger manual review.

Identity theft safeguards may also delay refunds if additional verification is needed.

Paper-filed returns are processed manually and move at a slower pace compared to electronic submissions.

If your return is selected for review, processing can extend beyond 21 days.

Average IRS Refund Amounts in 2026

Refund amounts vary widely based on income, tax withholding, and credit eligibility.

In recent years, the average federal refund has ranged between $2,500 and $3,500. Families claiming refundable credits may see larger refunds, while others may receive smaller amounts or owe taxes instead.

Your refund represents the difference between what you paid throughout the year and what you actually owed after applying deductions and credits.

A larger refund does not necessarily mean you paid less tax — it may indicate higher withholding during the year.

How to Check Your 2026 Refund Status

The IRS provides online tools that allow taxpayers to track refund progress shortly after filing.

Electronic filers can typically check status within 24 hours of submission. Paper filers may need to wait several weeks before updates appear.

Refund tracking usually shows three stages:

Return received

Refund approved

Refund sent

Once approved, direct deposits typically arrive within a few business days.

Common Refund Delay Triggers in 2026

Some of the most frequent causes of delays include:

Incorrect banking information

Incomplete tax forms

Outstanding federal debts

Identity verification requests

High filing volume during peak weeks

If the IRS adjusts your refund amount, you will generally receive a notice explaining the reason.

Tips to Get Your Refund Sooner

To increase your chances of receiving your refund quickly:

File electronically instead of mailing your return.

Select direct deposit instead of requesting a paper check.

Double-check all income and personal details before submitting.

Keep supporting documents organized.

Respond promptly if the IRS contacts you for clarification.

Accuracy and early filing remain the best strategies for faster refunds.

Will Refunds Be Bigger in 2026?

Refund sizes depend on income levels, withholding adjustments, and any updates to tax credits or brackets.

If there are no major legislative changes, refund patterns are expected to remain similar to previous years. However, inflation adjustments and income changes may influence individual totals.

Staying informed about tax rule updates can help you better estimate your refund amount.

Conclusion

The updated IRS refund schedule for 2026 suggests that most electronic filers can expect their tax refunds within about 21 days. However, refundable credits, verification checks, or filing errors may extend wait times for some taxpayers.

Filing early, ensuring accuracy, and choosing direct deposit are the most effective ways to speed up your refund. By understanding the process and monitoring official updates, you can better plan for when your tax refund may arrive.

Disclaimer: This article is for informational purposes only and does not constitute tax advice. For personalized guidance, consult a qualified tax professional or official IRS resources.