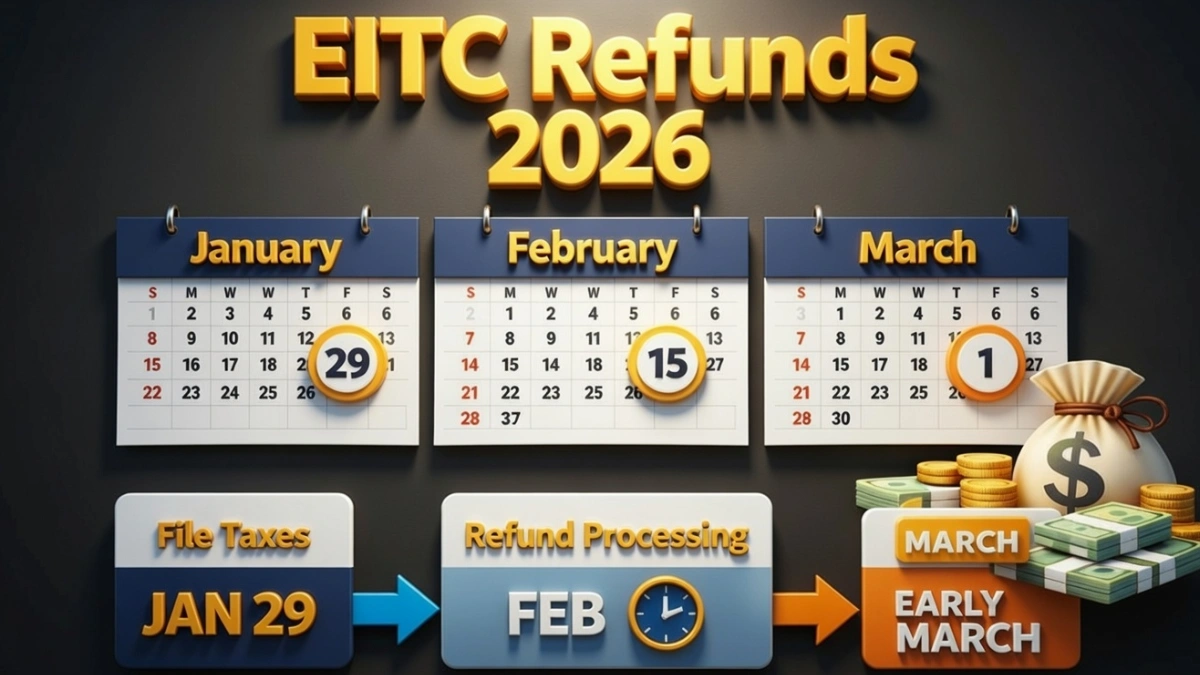

EITC Refund Alert 2026- Millions of Taxpayers Must Wait Until March for Their Money

EITC Refund Alert 2026– The IRS has confirmed that Earned Income Tax Credit (EITC) refunds in 2026 will be processed later than standard refunds, with many taxpayers receiving funds in March 2026. The delay is due to additional verification measures designed to prevent fraud and ensure accurate payments. Who Receives EITC Refunds EITC refunds are … Read more