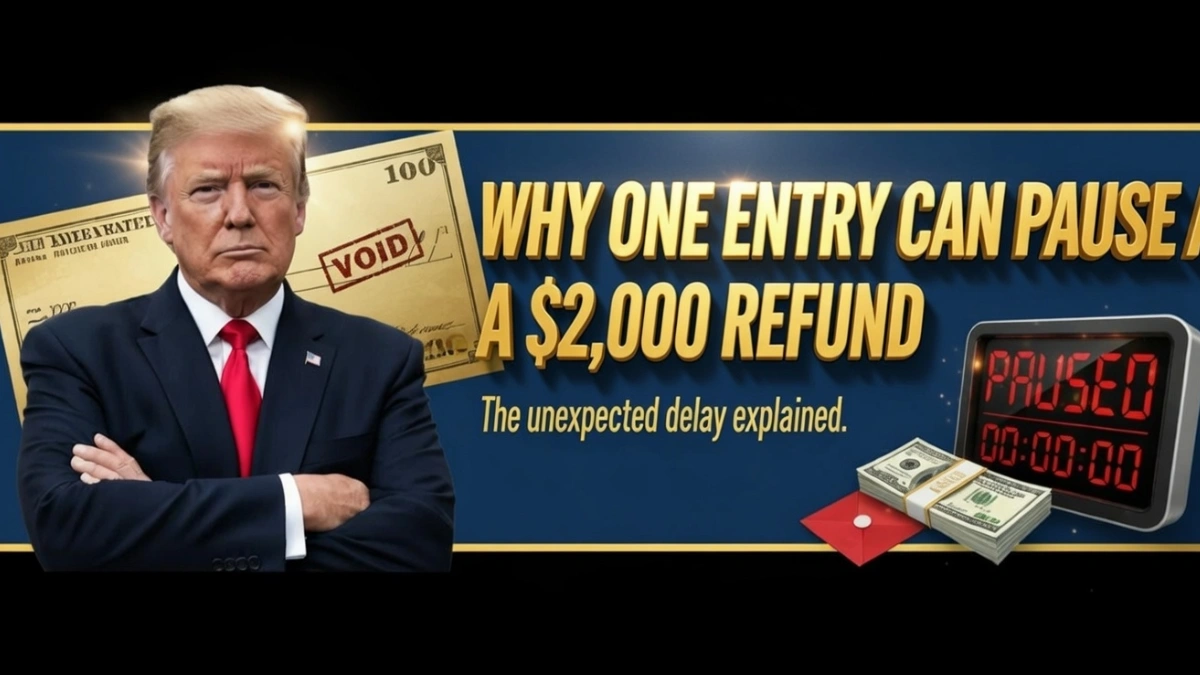

IRS Alert 2026! One Small Direct Deposit Error Can Delay Your $2,000 Tax Refund for Weeks | IRS refund rules 2026

IRS refund rules 2026– In 2026, stricter federal deposit verification rules are affecting how quickly tax refunds are released. Even a single incorrect entry on a return can pause a refund of around $2,000. These checks are designed to prevent fraud and ensure accuracy, but they also increase the chance of temporary holds for minor … Read more