The IRS Refund Schedule 2026 provides taxpayers with an estimate of when refunds will be issued and the expected payment amounts. Being aware of these dates helps individuals plan finances for bills, investments, and other personal expenses. Timely refunds depend on accurate filing and adherence to IRS guidelines.

Who Is Eligible for Refunds

Taxpayers who overpaid federal taxes, claimed eligible tax credits, or had deductions exceeding their tax liability qualify for refunds. Both individuals and businesses can expect refunds if all return requirements are met. Eligibility verification ensures that refunds are processed accurately.

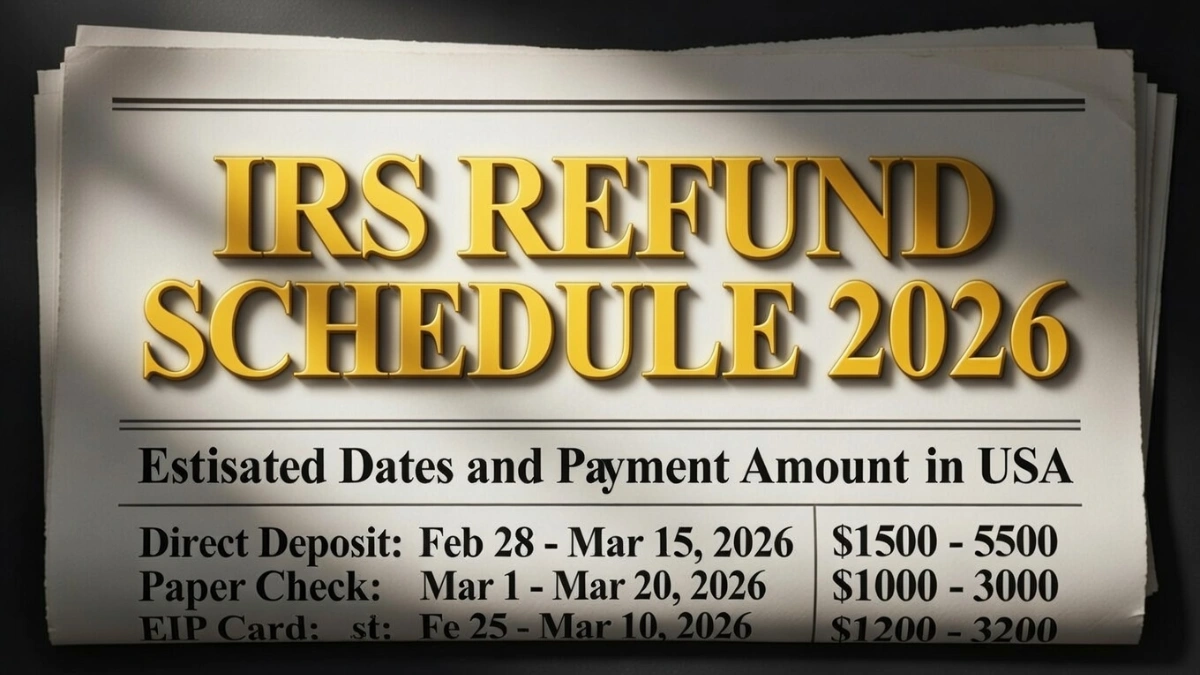

Estimated Refund Dates 2026

Refunds for e-filed tax returns are generally processed within 2–3 weeks of submission. Paper returns may take 6–8 weeks due to manual handling. Certain refundable credits, like the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), may experience additional verification periods before funds are released.

Factors That May Affect Refund Timing

Refund delays may occur due to errors in filing, mismatched personal information, bank account issues, or IRS system updates. Additionally, complex returns with multiple deductions, amendments, or late submissions may take longer to process. Filing early and accurately reduces the risk of delays.

How to Check Your Refund Status

Taxpayers can track refund status using the “Where’s My Refund?” tool or the IRS mobile app. Entering the Social Security number, filing status, and expected refund amount provides real-time updates. Monitoring the status ensures transparency and helps taxpayers plan their finances while waiting.

IRS Refund Schedule 2026 Overview

| Filing Type | Estimated Processing Time | Notes |

|---|---|---|

| E-filed returns | 2–3 weeks | Fastest processing, direct deposit recommended |

| Paper returns | 6–8 weeks | Slower due to manual handling |

| Refunds with EITC or CTC | Up to 21 days post-verification | Additional processing time required |

| Amended returns (Form 1040-X) | 12–16 weeks | Processed separately from main refund schedule |

This table summarizes the estimated refund dates and timelines for 2026.

Tips for Faster Refunds

Ensure all personal and bank information is accurate. E-file returns with direct deposit for the fastest processing. Avoid missing forms or mismatched data, and file early in the season. Using IRS-approved software or professional tax services can help minimize errors and delays.

Conclusion

The IRS Refund Schedule 2026 offers taxpayers a roadmap for when to expect refunds and approximate amounts. Filing accurately, using e-file, and monitoring refund status online ensures a smooth process. Awareness of estimated dates and potential delays helps taxpayers plan financial obligations efficiently.

Disclaimer: This article is for informational purposes only. IRS refund dates, amounts, and processing timelines are subject to change based on official IRS notifications, individual filings, and federal regulations.